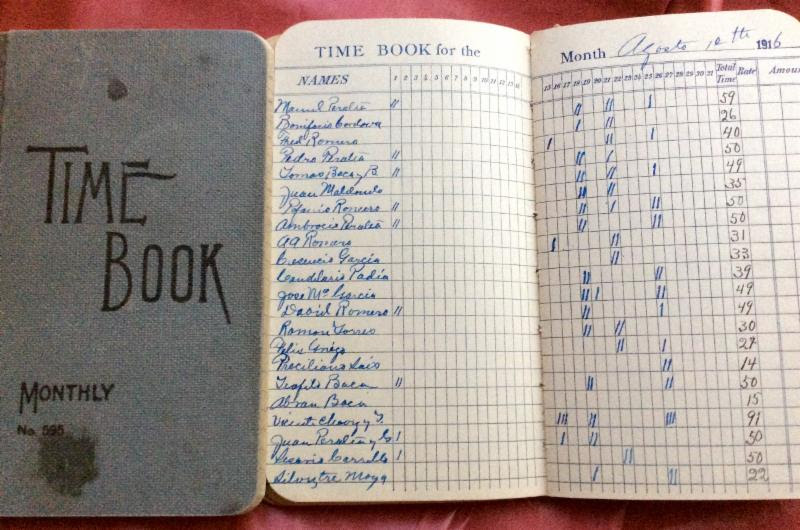

Great Grandfather's Ledger- Photo taken by Sarah Rivera-Cordova

As political subdivisions of the state, acequias are required to comply with the Audit Act, which includes the Tiered Reporting System for any entities with under $750,000 in annual revenue. Additionally, acequias are required to comply with budget reporting through DFA Local Government Division if annual revenues are over $10,000.

Acequia associations must comply with the state annual audit requirements. Those requirements arise from the Audit Act, Sections 12-6-1 through 12-6-14, NMSA 1978, and the Audit Rule, 2.2.2 NMAC. Section 2.2.2.16 of the Audit Rule addresses small political subdivisions like acequias. The Audit Rule is issued by the OSA and is available at https://www.saonm.org/

Audit Act Compliance:

- For Tier 1 (under $10,000) and Tier 2 (under $50,000), all acequias are required to complete a Certification Form online on the OSA website

-

Acequias in Tier 3 and above (those acequias with $50,000 or over or Capital Outlay expenditures), are required to contract with an Independent Public Accountant (IPA) to complete a financial report.

Deadlines - For acequias with a fiscal year end of December 30, 2016, the deadline to submit your reports to the State Auditor is May 30, 2017 (five months after the end of the fiscal year).

For acequias with a fiscal year end of June 30, 2017, the deadline to submit your reports to the State Auditor is November 30, 2017. All reporting to the Office of the State Auditor must be done through their online portal called OSA Connect: https://www.saonm.org/

All acequias regardless of annual income should register with OSA Connect to complete the tier forms or to generate a contact for an audit.

Budget and Reporting Requirements:

-

Many acequias must also comply with the state budget and reporting requirements, which arise primarily from the Local Government Finances statute, Sections 6-6-1 through 6-6-19, NMSA 1978, and the Budget Certification Rule, 2.2.3 NMAC. The Budget Certification Rule is issued by DFA and is available at http://www.nmcpr.state.nm.us/

NMAC/parts/title02/02.002. 0003.htmAcequias with annual revenues of less than $10,000 per year are exempt from the state budget and reporting requirements.

Budget Reporting Compliance (applies to all acequias with over $10,000 in revenue):

- DFA is accepting submissions online or in a paper format. The template forms are on the DFA website –

-

For acequias with a fiscal year start of January 1

- Interim or draft budget are due December 1 in anticipation of the following year.

- Final budget was due January 31st.

- Fourth Quarter Budget Report and Resolution due January 31st

- Quarterly reports are due 30 days after the end quarter.

All the forms you need for Budget compliance can be found at: or http://nmdfa.state.nm.us/

NMAA, in partnership with the Office of the State Auditor and the Department of Finance and Administration, provides detailed workshops, technical assistance, and educational materials to assist acequias with compliance. NMAA is available to assist with completing Tier 1 and Tier 2 forms and with DFA reporting, as well as all completing a budget and resolutions. NMAA also offers guidance to acequias which are Tier 3 and above, to register with OSA Connect and solicit bids from an IPA who will complete the "Audit" or Agreed Upon Procedures from the State.

Please call the NMAA office for more information 505-995-9644